For years, cable TV was the go-to option for entertainment, live sports, and catching up on the news. But things have changed these days; fewer and fewer people in the United States and worldwide are sticking with cable. The shift is real, and it’s happening fast.

Currently, Cable TV subscriptions are in just 68.7 million households in the United States. That’s a decline of 34.57% compared to 105 million cable TV subscribers recorded in 2010.

Let’s take a closer look at the number of Cable TV subscribers worldwide, in the United States, cable TV subscriber demographics, usage, and more in this post.

Cable TV Statistics 2024 — In A Nutshell

- As of 2024, 68.7 million people in the United States are subscribed to cable TV.

- Pay TV subscribers worldwide declined by around 20 million between 2021 and 2023.

- With 76 pay-TV subscriptions per 100 households, China has the highest pay-TV subscription penetration.

- 69% of the top content on Cable TV includes sports content.

- Over 8 in 10 people stated that price is the top reason for cutting cable TV cords.

Global Cable TV Statistics

Pay TV subscribers worldwide declined by around 20 million between 2021 and 2023.

The number of pay TV subscribers was 1.01 billion in 2021. Comparatively, the number declined to an estimate of 985 million in 2023.

That is a huge drop of 20 million subscribers in just 2 years, displaying the decreasing popularity of traditional pay TV platforms such as cable and satellite networks.

The following table displays the number of pay TV subscribers worldwide recorded over the years.

| Year | Number Of Pay TV Subscribers |

|---|---|

| 2023 | 985 million |

| 2022 | 993 million |

| 2021 | 1,013 million |

Source: Statista.

Cable TV Subscribers In The United States

As of 2024, 68.7 million people in the United States have cable TV subscriptions, a YoY decline of 4.9%.

In 2023, 72.2 million people in the United States had a cable connection.

Since 2011, the number of cable subscriptions has steadily decreased, driven by the rise of video streaming services and an increase in cord-cutting. This trend has led to a significant drop in cable TV subscribers in recent years.

Here is a table displaying the number of Cable TV subscribers in the United States by year:

| Year | Cable TV Subscribers | YoY Decline |

|---|---|---|

| 2024 | 68.7 million | 4.9% |

| 2023 | 72.2 million | 5% |

| 2022 | 76 million | 5% |

| 2021 | 80 million | 4.6% |

| 2020 | 83.8 million | 4.6% |

| 2019 | 88.6 million | 5.4% |

| 2018 | 93.4 million | 5.1% |

| 2017 | 96.3 million | 3.0% |

Source: IBIS World

How Many People Still Have Cable TV In The US?

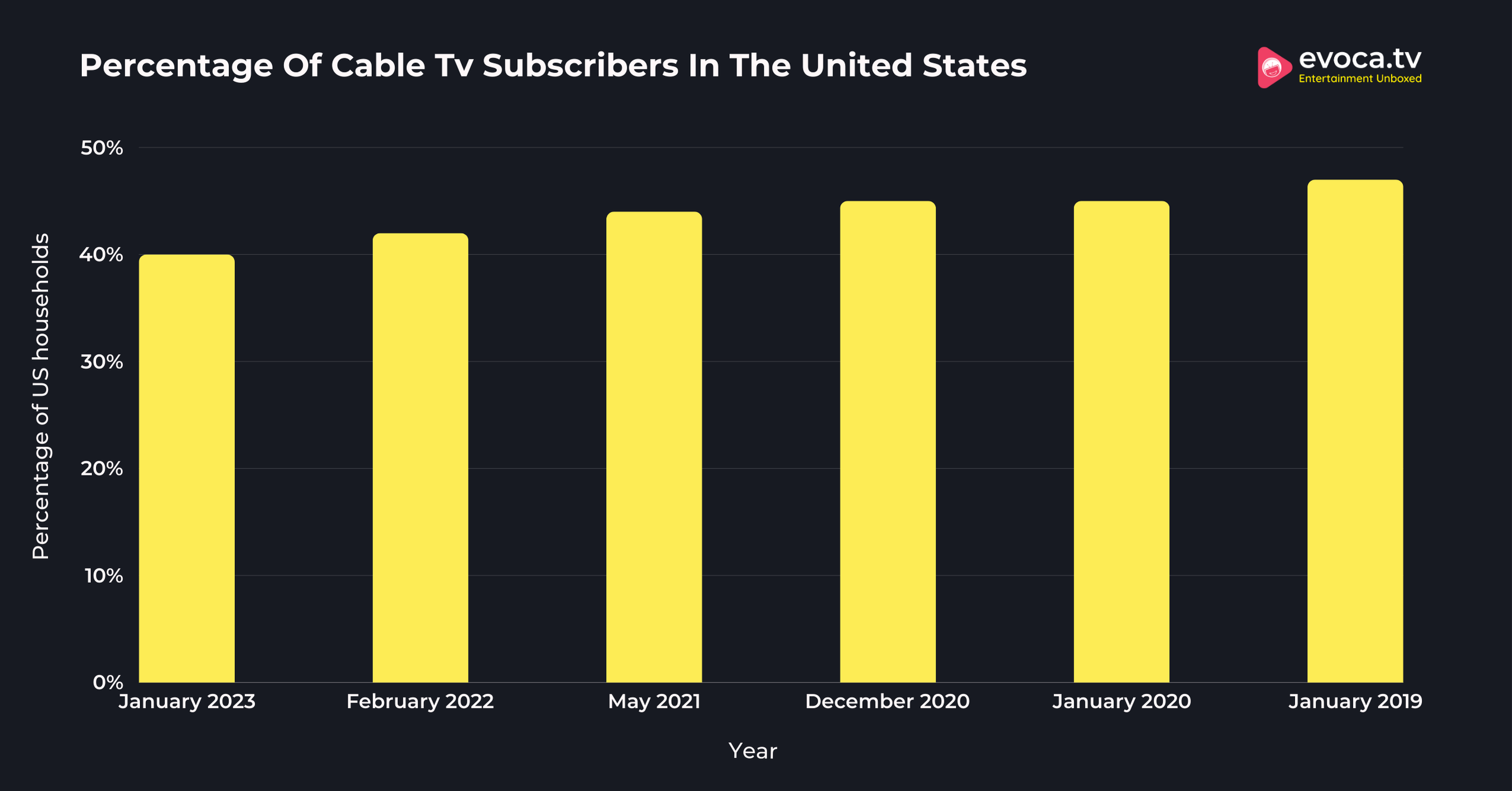

40% of the households in the United States still have a Cable TV.

According to a survey conducted in January 2023, 4 in 10 households in the United States still had a Cable TV connection.

Comparatively, 47% of households in the United States had a Cable TV connection in January 2019.

Cord cutting is a significant reason for the decline in Cable TV subscribers in the United States. The percentage of households in the United States that had a Cable TV subscription decreased by 7% between 2019 and 2023.

The following table displays the percentage of Cable TV subscribers in the United States according to the data recorded in 2023.

| Month-Year | Percentage Of US Households With Cable TV Connection |

|---|---|

| January 2023 | 40% |

| February 2022 | 42% |

| May 2021 | 44% |

| December 2020 | 45% |

| January 2020 | 45% |

| January 2019 | 47% |

Source: Statista

Demographics Of Cable TV Subscribers

50% of the adults in the United States aged 65 years and above have a subscription to Cable TV in the United States.

Comparatively, only one-third of the adults aged 18 to 34 subscribed to Cable TV in January 2023.

Adults aged 65 years or older stated they are more comfortable with cable TV subscriptions than other content streaming services.

The percentage of adults who subscribe to cable TV decreases with the decrease in the age group as younger pupils are more drawn towards streaming services.

The following table displays the percentage of adults in different age groups who have subscribed to cable TV in the United States as of January 2023.

| Age Group | Subscribed To Cable TV |

|---|---|

| 18-34 years | 34% |

| 35-44 years | 35% |

| 45-64 years | 41% |

| 65 years and older | 50% |

Source: Statista.

46% of the African American adults in the United States still have Cable TV.

African Americans had the highest share of adults using Cable TV in 2022.

At the same time, 39% of White adults and 37% of Hispanic adults have subscribed to Cable TV services in the United States.

The following table displays the number of adults in the United States who have subscribed to cable TV services as of January 2023.

| Ethnicity/ Race | Current Subscribers | Subscribed In The Past | Never Subscribed |

|---|---|---|---|

| White | 39% | 39% | 22% |

| Hispanic | 37% | 43% | 21% |

| African American | 46% | 34% | 20% |

| Other | 36% | 35% | 29% |

Source: Statista.

Cable TV Users By Country

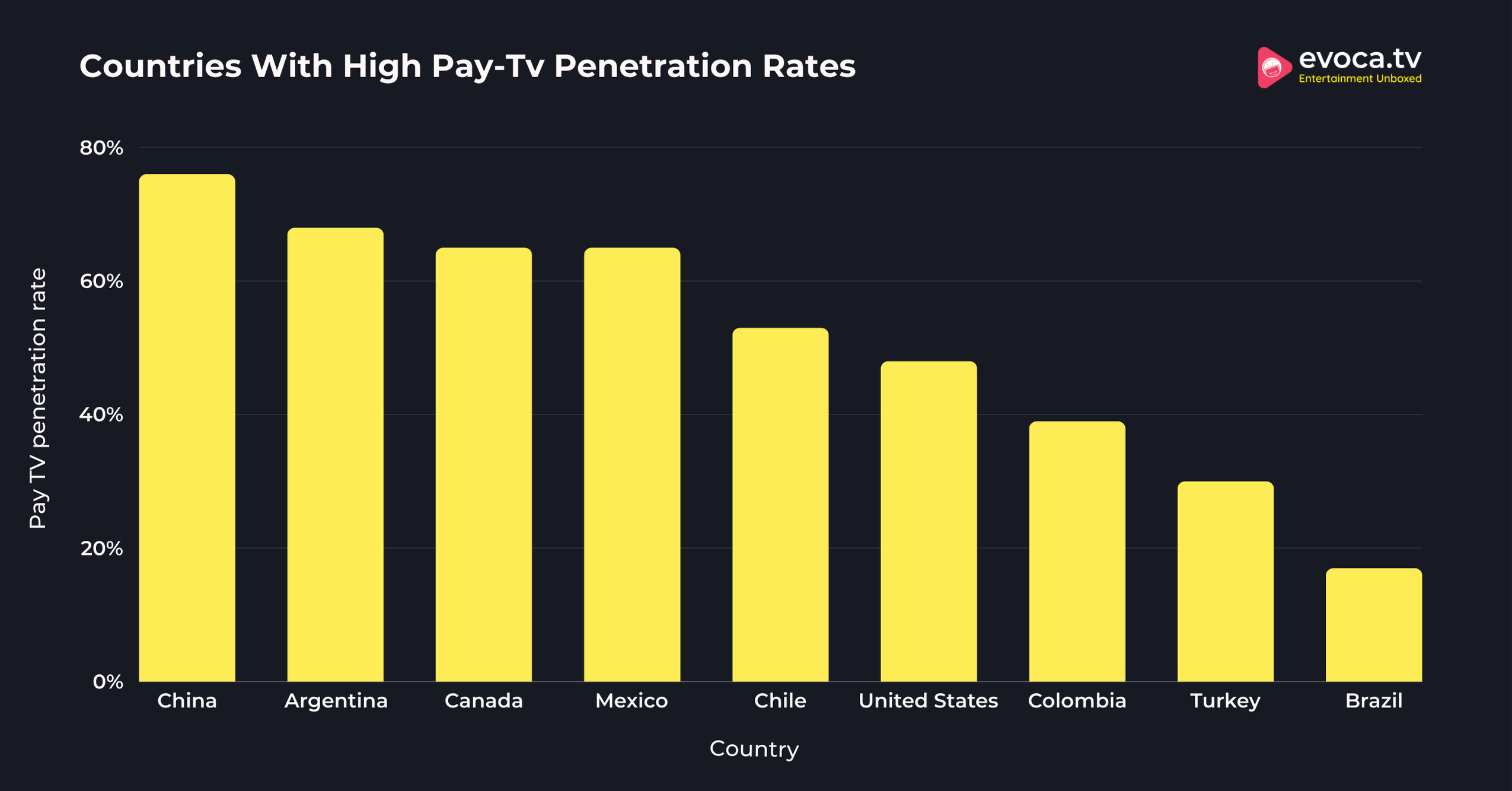

With 76 pay-TV subscriptions per 100 households, China has the highest pay-TV penetration rates.

In 2022, Argentina and Canada ranked just behind China, with 68 pay-TV subscriptions per 100 households in Argentina and 65 per 100 households in Canada.

Other countries with the highest pay-TV penetration rates worldwide are Mexico and Chile.

The following table displays the countries with high pay-TV penetration rates, including cable and satellite TV, as of 2022.

| Country | Number Of Pay TV Subscriptions Per 100 Households |

|---|---|

| China | 76 |

| Argentina | 68 |

| Canada | 65 |

| Mexico | 65 |

| Chile | 53 |

| United States | 48 |

| Colombia | 39 |

| Turkey | 30 |

| Brazil | 17 |

Source: Statista.

Cable TV Usage

38% of the adults aged 65 years and above watched Cable TV multiple times a Day

At the same time, 2 in 10 adults aged 35 to 44 years watched Cable TV multiple times a day.

Just 10% of the adults in the United States watched cable TV multiple times a day in 2022. Meanwhile, 13% of the adults in the same age group watched Cable TV a few times per week.

On the other hand, 7% of the adults aged 35 to 44 stated that they watched Cable TV once per week.

The following table displays the frequency of watching cable TV in the United States by age group according to the data recorded in 2022.

| Frequency | Age 18-34 | Age 35-44 | Age 45-64 | Age 65+ |

|---|---|---|---|---|

| Multiple times a day | 10% | 20% | 21% | 38% |

| Once daily | 8% | 8% | 8% | 9% |

| A few times per week | 13% | 11% | 7% | 4% |

| Once per week | 5% | 7% | 2% | 0% |

| A few times | 7% | 8% | 4% | 3% |

| Once | 4% | 3% | 3% | 1% |

| Never | 52% | 43% | 55% | 45% |

Source: Statista.

24% of the male users watch cable TV multiple times a day.

Meanwhile, 19% of female users prefer to watch Cable TV multiple times a day.

Further 10% of the male users stated that they watched cable TV once daily and another 10% of the male users stated that they watched Cable TV a few times a week.

The following table provides detailed information about the frequency at which the male and female adults in the United States watched TV.

| Frequency | Male | Female |

|---|---|---|

| Multiple times a day | 24% | 19% |

| Once daily | 10% | 7% |

| A few times per week | 10% | 7% |

| Once per week | 4% | 3% |

| A few times | 6% | 5% |

| Once | 2% | 3% |

| Never | 43% | 56% |

Source: Statista.

31% of the Baby Boomers stated that they watched cable TV multiple times a day in the United States.

At the same time, 2 in 10 Gen X adults said the same in 2022.

Besides, 11% of GenZ stated that they watched Cable TV a few times per week, and 13% of the millennials said the same.

The study revealed that the younger generations in the United States were less likely to watch cable TV daily than the older generations. Conversely, a higher share of the younger generation watched Cable TV a few times a week.

The following table displays the share of adults in the United States who watch cable TV at different frequencies by generation.

| Frequency | Gen Z | Millennials | Gen X | Baby Boomers |

|---|---|---|---|---|

| Multiple times a day | 8% | 15% | 20% | 31% |

| Once daily | 9% | 8% | 7% | 9% |

| A few times per week | 11% | 13% | 7% | 5% |

| Once per week | 8% | 5% | 3% | 1% |

| A few times | 9% | 6% | 6% | 4% |

| Once | 5% | 3% | 3% | 1% |

| Never | 50% | 50% | 53% | 50% |

Source: Statista.

Cable TV Sports Viewership Statistics

69% of the top content on Cable TV includes sports content.

That means a higher share of viewership on cable TV is received from sports content.

As a result, 43% of sports fans could not cancel their cable TV subscription. Nearly half of sports fans prefer to watch live broadcasts of their favorite sports on Cable TV, leading to a lower rate of cord-cutting than expected.

Source: Play Today.

Cable TV News Viewership Statistics

21% of the adults in the United States used Cable TV to get daily news updates in 2022.

At the same time, 15% of the adults said they used Cable TV to get the news a few times per week.

Conversely, 39% of the adults in the United States said that they never used cable TV to get news updates.

The following table displays the frequency at which adults in the United States used Cable TV to get news updates.

| Frequency | Percentage Of Adults In The United States |

|---|---|

| Daily | 21% |

| A few times per week | 15% |

| Once per week | 6% |

| A few times per month | 8% |

| Once per month | 3% |

| Less often than once per month | 8% |

| Never | 39% |

Source: Statista.

In 2023, Fox News was the leading cable TV news provider in the United States, with a 1.72 million primetime audience.

Apart from sports, cable TV users prefer to watch the news on their TVs the most. Fox News was the top choice of cable TV users, and MSNBC and CNN News networks followed it.

The following table displays the leading cable News Networks in the United States as of 2023, ranked according to the number of Prime-Time Viewers.

| Cable TV News Network | Number Of Primetime Viewers |

|---|---|

| Fox News | 1.72 million |

| MSNBC | 1.14 million |

| CNN | 540,000 |

Source: Statista.

Why Are People Cutting Cable?

Over 8 in 10 people stated price as the top reason for cutting cords.

Most households have subscribed to traditional TV or cable TV as well as other streaming services, making Cable TV unaffordable for users.

Besides, nearly 4 in 10 users preferred streaming services more than Cable TV as they had fewer ads and displayed content according to their taste.

Other top reasons to cut the cords were that the users switched to antennae TV, preferred to binge-watch the content, and were moving to another place and didn’t wish to renew their cable TV subscription.

The following table highlights the top reasons adults in the United States are cutting the cords of their cable TV and switching to other available options.

| Reason | Percentage Of Cord Cutters |

|---|---|

| Price | 86.7% |

| Preference for streaming | 39.7% |

| Switching to Antennae TV | 23% |

| Prefer binge watching | 15.9% |

| Moving and don’t wish to renew services | 13% |

| Prefer original content on streaming platforms | 7.7% |

Source: Broadband Search.

Over 3 in 10 adults who removed their Cable TV connection in 2022 said the cable was too expensive for them.

Besides, 5.04% of the cord-cutters said that they stopped watching live news and no longer needed access to the Cable.

At the same time, 1.8% of the Cable cutters reported that they stopped watching live sports on the cable.

Further, 3.87% of the adults stated that their parents persuaded them to cut cable, while 3.9% stated that they were persuaded by their child or children to cut the cable.

The following table displays the top reasons stated by adults in the United States for cutting off their connection to Cable TV.

| Reason To Cut the Cord Of Cable TV | Percentage Of Cord Cutters |

|---|---|

| The cable was too expensive | 31.02% |

| Did not use cable enough to justify the cost | 8.03% |

| Was not satisfied with the service I was receiving | 6.53% |

| The cable was too difficult to use | 5.79% |

| Stopped watching live news on cable | 5.04% |

| There are no/fewer commercials on streaming services | 4.16% |

| child/children persuaded them | 3.9% |

| parent(s) persuaded them | 3.87% |

| stopped watching live entertainment events on cable | 3.81% |

| stopped watching political content on cable | 3.71% |

| Moved to a location that did not have cable access | 3.37% |

Source: Statista.

Impact Of The Decline In Cable TV

By 2027, the television industry in the United States is projected to witness a decline of $30 billion in traditional pay TV subscriptions and ad revenue compared to 2017.

Cord cutting is cited to be the major reason for this decline.

By 2027, the global TV subscription revenue is projected to have declined to $173.6 billion from the $200 billion market recorded a decade earlier. The global TV subscription revenue is expected to decline at 0.9% CAGR between 2022 and 2027.

On the other hand, the TV advertising market is projected to reach $160.1 billion between 2017 and 2027, growing at a CAGR of 0.5%.

Source: Hollywood Reporter.

Cable TV Financials

American cable TV and Pay TV providers registered a total revenue of $92.42 billion in 2022.

That was a revenue decrease of nearly 1 billion in 2022 from the $93.49 billion generated by American Cable and Pay TV providers in 2021.

The following table displays the estimated revenue generated by Cable TV and Pay TV providers in the United States over the years.

| Year | Cable TV and Pay TV Provider’s Revenue |

|---|---|

| 2022 | $92.42 billion |

| 2021 | $93.49 billion |

| 2020 | $86.25 billion |

| 2019 | $84.74 billion |

| 2018 | $91.42 billion |

| 2017 | $89.1 billion |

| 2016 | $85.93 billion |

| 2015 | $82.06 billion |

| 2014 | $74.4 billion |

| 2013 | $69.3 billion |

| 2012 | $63.6 billion |

Source: Statista.

The revenue registered by pay TV alone is projected to decline by 12.5 million between 2020 and 2027.

As a result of cord-cutting and the increased popularity of Streaming services and other services, the pay-TV revenue and advertising revenue of Traditional TV is projected to witness a significant decline in the upcoming years.

The advertising revenue of traditional TV is projected to decline to $53.13 billion in 2027 from $62.28 billion recorded in 2022. That is a nearly $9 billion decrease in advertising revenue in just 5 years.

The following table displays the revenue of the traditional TV and home video market by segment in the United States over the years.

| Year | Pay TV Revenue | Traditional TV Advertising Revenue | Physical Home Video Revenue |

|---|---|---|---|

| 2027* | 81.33 billion | 53.13 billion | 2.59 billion |

| 2026* | 82.39 billion | 55.15 billion | 2.76 billion |

| 2025* | 83.42 billion | 57.16 billion | 2.92 billion |

| 2024* | 84.29 billion | 59.18 billion | 3.09 billion |

| 2023* | 84.89 billion | 61.04 billion | 3.25 billion |

| 2022 | 86.21 billion | 62.28 billion | 3.44 billion |

| 2021 | 93.17 billion | 63.26 billion | 3.87 billion |

| 2020 | 93.83 billion | 63.71 billion | 4.07 billion |

| 2019 | 97.53 billion | 68.52 billion | 4.26 billion |

| 2018 | 98.81 billion | 69.58 billion | 4.45 billion |

| 2017 | 100.09 billion | 68.47 billion | 4.63 billion |

*-projected values

Source: Statista.

Cable TV vs Streaming Statistics

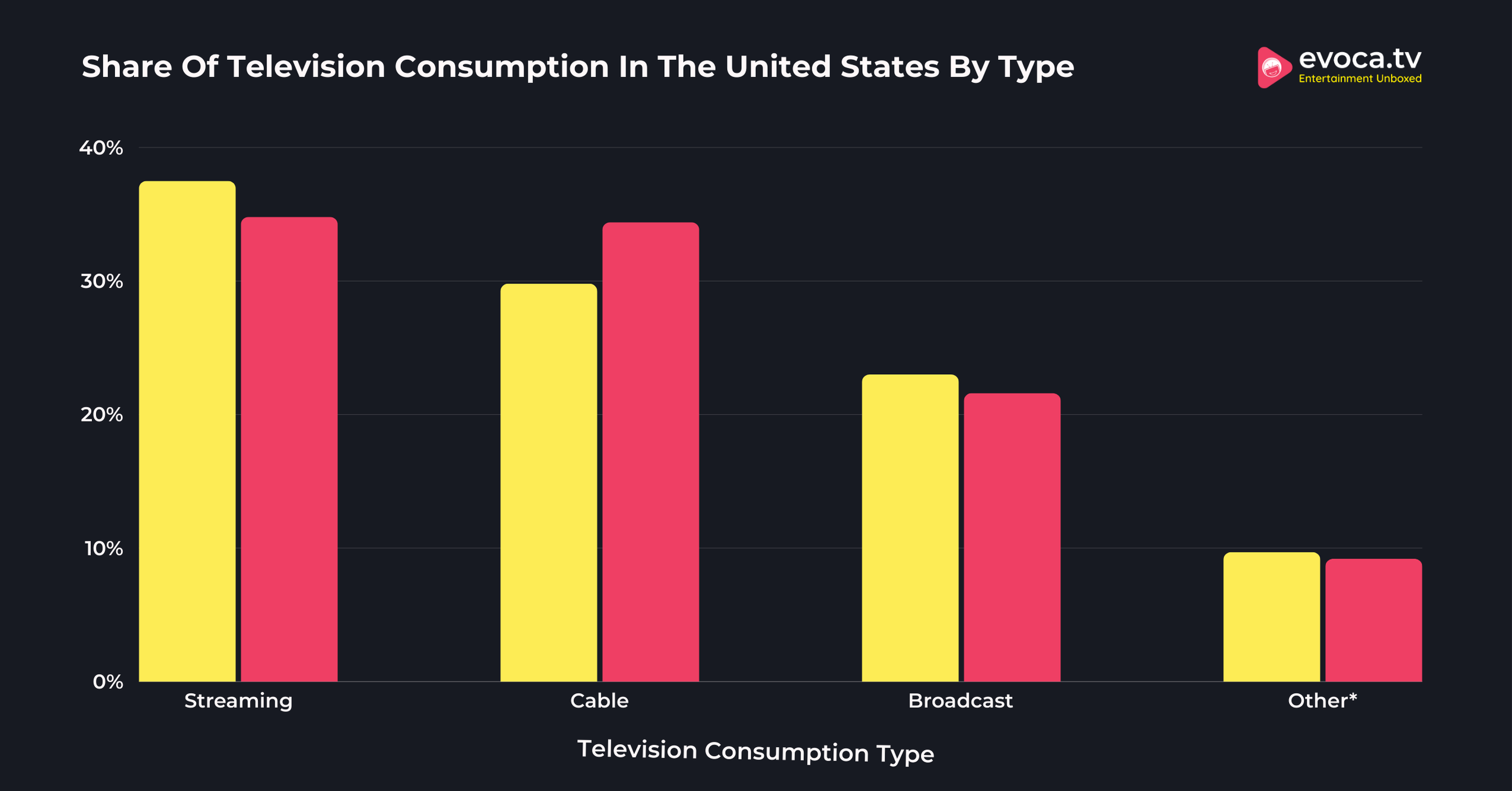

Cable TV accounts for 29.8% of TV consumption in the United States, while Streaming accounts for 37.5%.

Meanwhile, broadcasts accounted for 23% of TV consumption in the United States in September 2023.

Streaming services surpassed the consumption of Cable TV services for the first time in July 2022. At that time, streaming services accounted for 34.8% of daily TV consumption, while Cable TV and Broadcast accounted for 34.4% and 21.6%.

Later, the streaming’s share of v consumption peaked at 38.7% in July 2023 and later declined to 37.5% in September 2023.

The following table displays the share of television usage in the United States by type in September 2023.

| Television Consumption Type | September 2023 | July 2022 |

|---|---|---|

| Streaming | 37.5% | 34.8% |

| Cable | 29.8% | 34.4% |

| Broadcast | 23.0% | 21.6% |

| Other* | 9.7% | 9.2% |

*- Adjusted Values

Source: Statista.

Related Read:

Conclusion: 40% Of US Households Still Subscribed To Cable TV!

Despite the declining usage of cable TV in the United States, half of the adults aged 65 and over prefer cable TV over other types of content streaming services. At the same time, one-third of the younger generation reported having a Cable TV subscription in their household.

A majority of TV users cited that they prefer watching live sports on News on cable TV over other services. Hence, Cable TV is here to stay for the next few decades until baby boomers and Gen X survive.

That was all about cable TV statistics from my side.

Are you, too, a cable TV user, or have you cut the cords? Let us know in the comment section below.