The cable television industry in the United States is expected to witness a $30 billion fall in traditional pay-TV subscriptions and ad revenue compared to 2017 data, as a lot of users are cutting cords for flexible entertainment options.

The cord-cutters cited the high costs of traditional cable TV subscriptions as a significant reason to switch to streaming services. Over 80.7 million households in the United States are projected to use non-pay TV services by 2026.

Let’s take a detailed breakdown of the number of cord cutters in the United States, reasons for cord cutting, consumer behavior, the impact of cord cutting, and more in this article.

Cord Cutting Statistics (Editor’s Pick)

- 59.6 million households in the United States are estimated to have switched to non-pay TV.

- 68.7 million people in the country still have a subscription to Cable TV.

- 86.7% of the people reported cutting the cords due to the high price.

- Pay TV revenue decreased from $100.09 billion in 2017 to $86.21 billion in 2022.

- YouTube TV is the most-watched virtual multichannel video programming distributor (vMVPD) services in the United States, with 7.9 million subscribers in 2023.

US Cord-Cutting Statistics

According to the most recent data, it is estimated that 80.7 million households in the United States will cut the cord by 2026!

To give you a better idea of the upcoming scenario, only 54.3 million households are expected to remain subscribed to traditional Pay TV by then.

Here is a breakdown of the number of pay TV households and non-pay TV households in the United States by year.

| Year | Pay TV Households | Non-Pay-TV Households |

|---|---|---|

| 2026* | 54.3 million | 80.7 million |

| 2025* | 56.8 million | 77.2 million |

| 2024* | 59.6 million | 73.2 million |

| 2023* | 62.8 million | 68.9 million |

| 2022* | 66.4 million | 64.3 million |

| 2021 | 71.6 million | 58.3 million |

| 2020 | 77.5 million | 50.9 million |

| 2019 | 84.4 million | 44.6 million |

| 2018 | 90.3 million | 37.3 million |

*estimated numbers

The data shows a significant shift in US household preferences from Pay TV to non-Pay-TV services between 2018 and 2026.

In 2018, Pay TV used to dominate with 90.3 million subscribers, while Non-Pay-TV services had only 37.3 million subscribers. However, by 2026, noin-Pay-TV subscribers are expected to surpass Pay TV subscribers, marking a significant change in consumer behavior.

Source: eMarketer

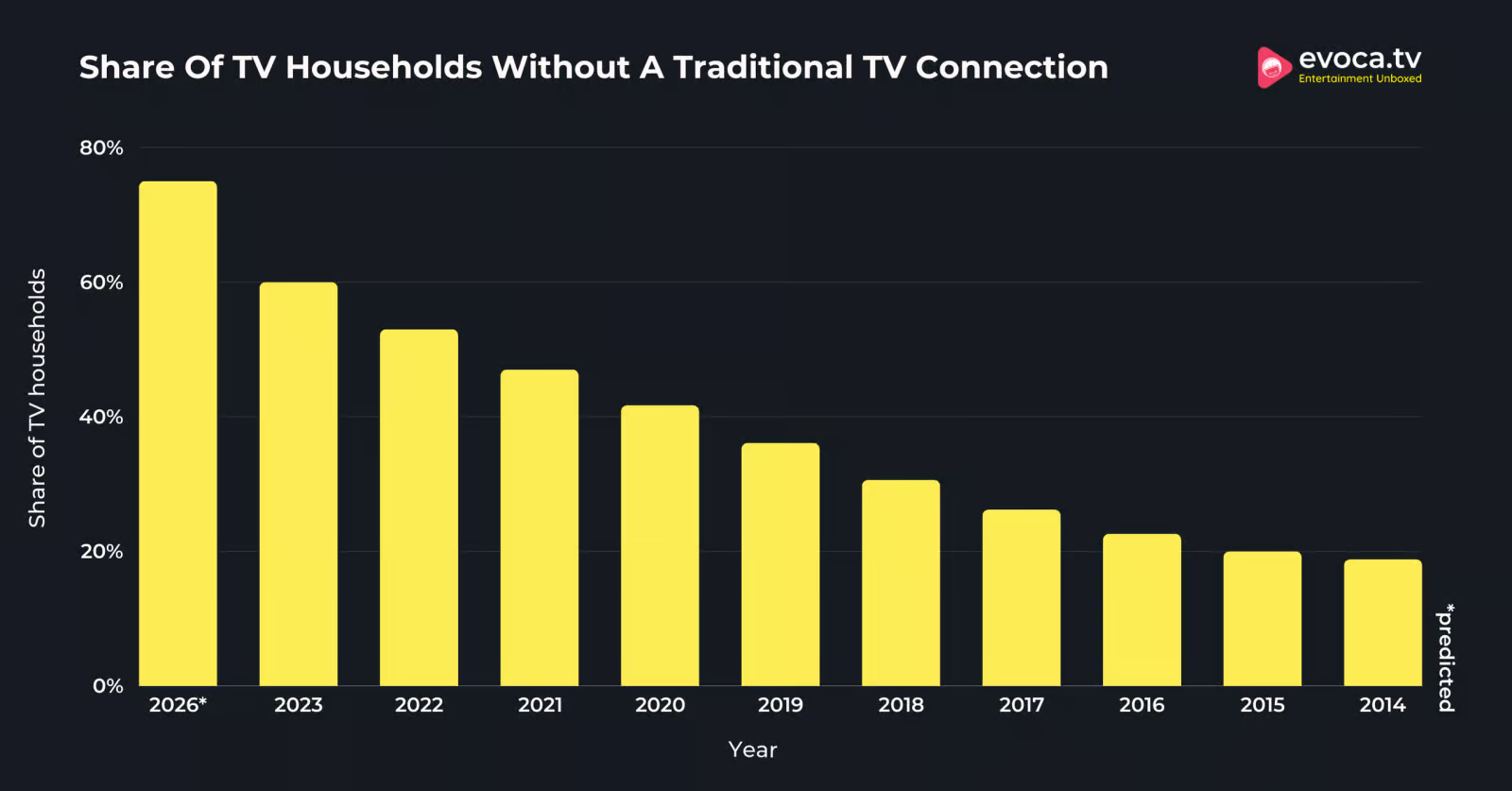

By the end of 2026, it is anticipated that 75% of U.S. households with a TV will no longer have a traditional TV subscription.

In 2023, over 60% of US households with a TV reported not having a traditional TV subscription. This represents a 7% increase compared to the previous year.

Further, only 20% of households with a TV did not have a TV connection in 2015.

The following table displays the share of households with a TV but do not own a traditional TV connection in the United States.

| Year | Share of TV Households Without A Traditional TV Connection |

|---|---|

| 2026* | 75% |

| 2023 | 60% |

| 2022 | 53% |

| 2021 | 47% |

| 2020 | 41.7% |

| 2019 | 36.1% |

| 2018 | 30.6% |

| 2017 | 26.2% |

| 2016 | 22.6% |

| 2015 | 20% |

| 2014 | 18.8% |

Source: Statista

64% of the adults in the United States stated that they had some sort of live pay-TV service.

These live pay TV services were cable, DBS, telco, or internet-delivered vMVPD.

The Pay TV penetration rate in the United States dropped by 2% in 2023 compared to 2022. At the same time, the Pay TV penetration rate in the country witnessed a drop of 20% in a decade, that is, between 2014 and 2023.

Besides, the pay TV penetration rates in the United States have been declining steadily since 2010 after reaching the highest penetration rate of 88%.

The following table displays the pay TV penetration rates in the United States recorded over the years.

| Year | Pay TV Penetration Rate in US Households |

|---|---|

| 2023 | 64% |

| 2022 | 66% |

| 2021 | 71% |

| 2020 | 74% |

| 2019 | 75% |

| 2018 | 78% |

| 2017 | 79% |

| 2016 | 82% |

| 2015 | 85% |

| 2014 | 84% |

| 2013 | 86% |

| 2012 | 87% |

| 2011 | 87% |

| 2010 | 88% |

| 2005 | 82% |

Source: Statista

Pay TV providers in the United States lost 5.04 million net subscribers.

Comparatively, 4.6 million net subscribers had cut down on pay TV in the United States in 2022. Besides, pay-TV providers lost only 125,780 subscribers in the US in 2014.

Further, the number of pay TV subscribers lost in the United States almost doubled between 2017 and 2019.

The following table displays the number of net subscribers that pay TV providers lost in the United States over the years.

| Year | Number of Net Subscribers Lost |

|---|---|

| 2023 | 5,035 K |

| 2022 | 4,590 K |

| 2021 | 4,689.24 K |

| 2020 | 5,118.63 K |

| 2019 | 4,913.96 K |

| 2018 | 2,874.47 K |

| 2017 | 1,493.25 K |

| 2016* | 796.9 K |

| 2015 | 383.47 K |

| 2014 | 125.78 K |

How Many People Still Have Cable?

68.7 million people in the United States still have cable TV.

This represents a 4.9% decline from 2023, when 72.2 million people subscribed to cable TV.

The following table displays the number of cable TV subscribers by year:

| Year | Cable TV Subscribers | YoY Decline |

|---|---|---|

| 2024 | 68.7 million | 4.9% |

| 2023 | 72.2 million | 5% |

| 2022 | 76 million | 5% |

| 2021 | 80 million | 4.6% |

| 2020 | 83.8 million | 4.6% |

| 2019 | 88.6 million | 5.4% |

| 2018 | 93.4 million | 5.1% |

| 2017 | 96.3 million | 3.0% |

From 2017 to 2024, there’s been a noticeable and steady drop in the number of Cable TV users in the United States. The rate of decline varied each year, hitting a high of 5.4% in 2019 before leveling off around 5%.

This trend clearly shows that more and more people are moving towards video streaming services, reflecting changing preferences and the growing influence of digital media on viewing habits.

Source: IBIS World

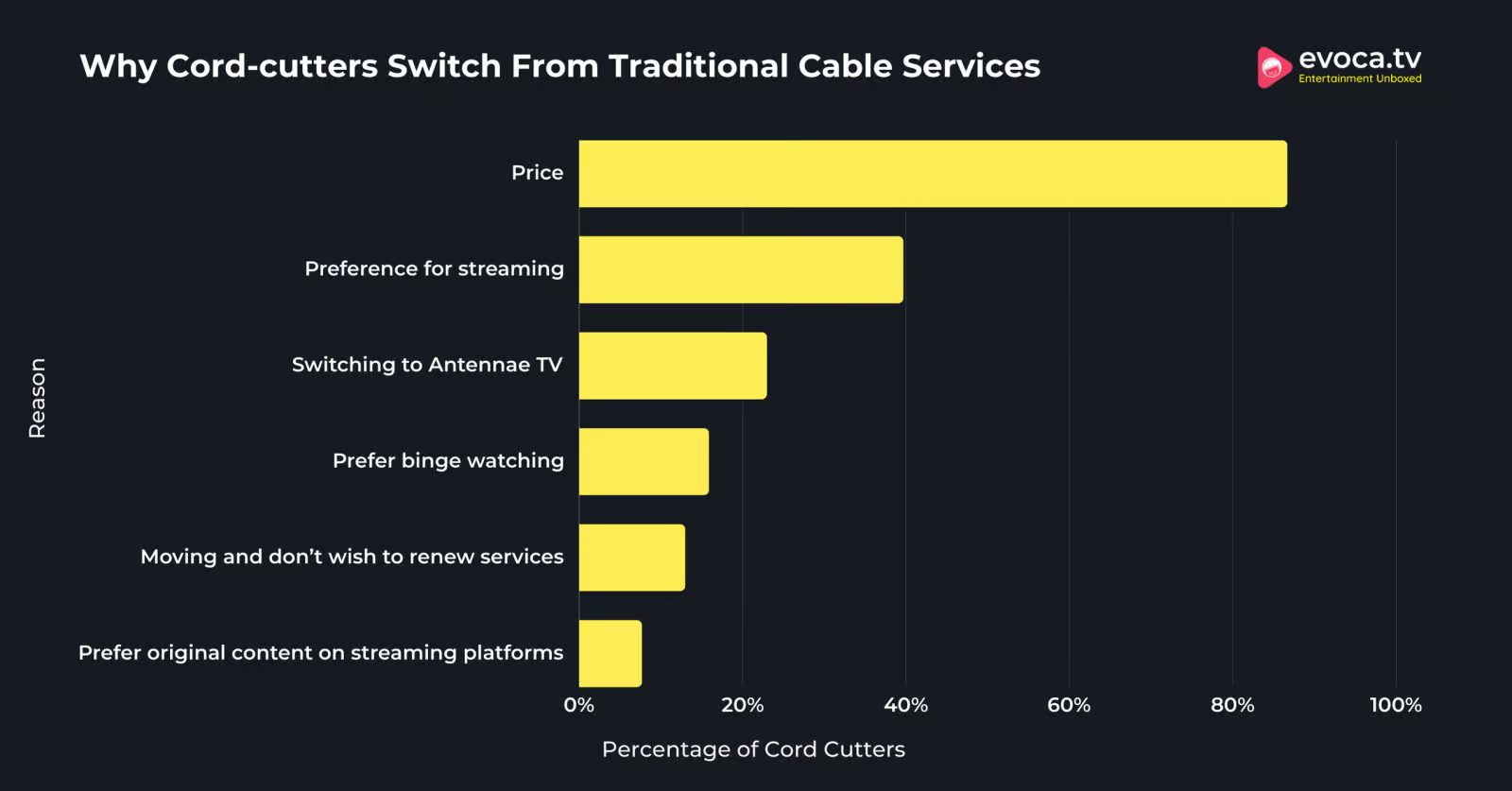

Why Do People Cut The Cord (Key Reasons)

86.7% of the people reported cutting the cords due to the price.

The majority of people worldwide are cutting cords to save money, as paying for traditional TV is quite pricey compared to buying other subscriptions.

The second majority, or 2 in 5 cord-cutters, stated that the main reason they removed traditional TV cable was their preference for streaming, while 23% said that they were switching to antenna TV.

Conversely, 7.7% of cord-cutters said they prefer to watch original content on streaming services over other content.

The following table displays the reasons why cord-cutters switch from traditional cable services.

| Reason | Percentage of Cord Cutters |

|---|---|

| Price | 86.7% |

| Preference for streaming | 39.7% |

| Switching to Antennae TV | 23% |

| Prefer binge watching | 15.9% |

| Moving and don’t wish to renew services | 13% |

| Prefer original content on streaming platforms | 7.7% |

Source: Broadband Search

Almost three-quarters (73%) of Americans said they ditched cable because it was too pricey.

Meanwhile, 20% of people mentioned they no longer need cable to watch their favorite shows. Additionally, 5% of those who cut the cord found the cable too complicated to use.

Source: Statista.

Cord-Cutting Consumer Statistics

Nearly 27% of the adults in Q2 2023 in Canada and the United States planned to cut the cords by the end of 2023.

At the same time, 28.8% of the consumers in the United States and Canada planned to cut the cords in Q4 2022.

The following table displays the share of consumers who had planned to cut the cords by the end of 2023.

| Year | Percentage Of Consumers In The US And Canada Who Planned To Cut Cords |

|---|---|

| Q2 2023 | 27% |

| Q4 2022 | 28.8% |

| Q4 2021 | 24.2% |

| 2018 | 18.8% |

| 2017 | 13% |

Source: Statista

A survey from March 2024 revealed that 10% of Americans are very likely to cancel their cable subscriptions within the next year.

Most adults looking to cancel their cable subscriptions were between the ages of 35 and 55, whereas only 4% of those over 55 expressed a desire to do so.

The following table displays the distribution of the people in the United States who said they are likely to cancel their pay TV services by age group in the next 12 months.

| Likelihood Score | 18 to 34 Years | 35 to 54 Years | Over 55 Years | All |

|---|---|---|---|---|

| 1 – Not at all likely | 35% | 33% | 50% | 41% |

| 2 | 14% | 20% | 22% | 20% |

| 3 | 21% | 18% | 15% | 17% |

| 4 | 15% | 13% | 9% | 11% |

| 5 – Extremely Likely | 15% | 16% | 4% | 10% |

Source: Statista

Over one-third of US and Canadian cord-cutters resubscribed to pay TV services because they could not get all the entertainment they wanted.

At the same time, over 2 in 10 US and Canadian cord-cutters who subscribed to pay TV said that the services were not very expensive.

29.1% of the people who resubscribed said it was the best way to watch major live events.

The following table displays the reasons stated by the cord-cutters in the United States and Canada who resubscribed to pay TV services in the 4th quarter of 2022.

| Reasons | The Percentage Of Subscribers |

|---|---|

| Couldn’t get all the entertainment they wanted | 33.8% |

| Consider it the best way to watch major live events | 29.1% |

| Consider it the best way to watch local programming | 27.5% |

| Consider it the best way to watch sports | 27.1% |

| like knowing they always have many channels available | 25.8% |

| have entertainment components that only work with pay TV | 23.2% |

| Think that service is not very expensive | 19.7% |

| Streaming video services are not as reliable | 18.8% |

| got TV service bundled with my broadband Internet service | 17% |

| They can easily skip the ads when recording programs from pay TV | 17% |

Source: Statista

Impact Of Cord-Cutting

Pay TV revenue decreased from $100.09 billion in 2017 to $86.21 billion in 2022

As a result of cord-cutting, pay TV revenue declined by $13.88 billion in just five years between 2017 and 2022.

The Pay TV revenue is estimated to be $84.29 billion.

At the same time, traditional TV advertising revenue decreased from $68.47 billion in 2017 to $62.28 billion in 2022. This is a decrease of $6.19 billion in the span of 5 years.

The following table displays the distribution of the revenue of the traditional TV and home video market by segment.

| Year | Pay TV Revenue | Traditional TV Advertising Revenue | Physical Home Video Revenue |

|---|---|---|---|

| 2027* | 81.33 billion | 53.13 billion | 2.59 billion |

| 2026* | 82.39 billion | 55.15 billion | 2.76 billion |

| 2025* | 83.42 billion | 57.16 billion | 2.92 billion |

| 2024* | 84.29 billion | 59.18 billion | 3.09 billion |

| 2023* | 84.89 billion | 61.04 billion | 3.25 billion |

| 2022 | 86.21 billion | 62.28 billion | 3.44 billion |

| 2021 | 93.17 billion | 63.26 billion | 3.87 billion |

| 2020 | 93.83 billion | 63.71 billion | 4.07 billion |

| 2019 | 97.53 billion | 68.52 billion | 4.26 billion |

| 2018 | 98.81 billion | 69.58 billion | 4.45 billion |

| 2017 | 100.09 billion | 68.47 billion | 4.63 billion |

Streaming Services And VMVPDS

With 7.9 million subscribers in 2023, YouTube TV is the most-watched virtual multichannel video programming distributor (vMVPD) service in the United States.

Hulu follows YouTube with 4.6 million subscribers in the United States. It is the second most-watched vMPD service in the United States.

Most cord-cutters in the United States have shifted towards these vMPD services to access full entertainment packages.

The following table displays the number of people in the United States who have subscribed to selected vMVPD services in 2023.

| vMVPD Services | Number of Subscribers In The United States |

|---|---|

| YouTube TV | 7.9 million |

| Hulu + Live TV | 4.6 million |

| Sling TV | 2.06 million |

| Fubo | 1.62 million |

Source: Statista

Related Data & Stats:

Conclusion: Cable And Satellite TV Have Lost Over 20 Million US Subscribers Since 2014

We see the world of TV entertainment evolving with the inclination of subscribers towards flexible digital streaming platforms. The number of people cutting the cord is increasing sharply every year. Cord-cutting has drastically impacted the cable television industry, leading to a decline of 20% in the pay TV penetration rates between 2014 and 2023. This has also resulted in a decrease of $13.88 billion in the pay-TV revenue between 2017 and 2022.

On the other hand, streaming services like Amazon Prime, Netflix, Hulu, etc, have gained popularity in the past decade. Currently, 99% of households in the United States subscribe to at least one streaming service.